Get the free income tax

Show details

Docketing Statement Changes DSCB 15-134B BUREAU USE ONLY Revenue Labor Industry Other File Code Filed Date Part I. Complete for each filing Current name of entity or registrant survivor or new entity if merger or consolidation Entity number if known State of Inc Incorporation/qualification date in PA Federal EIN Specified effective date if any Part II. Check proper box Amendment complete Section A Merger Consolidation or Division complete Section B C or D Consolidation complete Section C...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income tax withheld form

Edit your docketing statement 15 134b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxed accrued form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit taxpayer income excess online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax withheld excess form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income tax property form

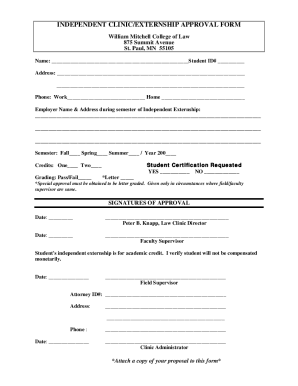

How to fill out DSCB 15-134B

01

Begin by downloading the DSCB 15-134B form from the appropriate regulatory website.

02

Fill in your contact information at the top of the form, including your name, address, and phone number.

03

Provide details about the entity involved, such as the name and address of the business.

04

Complete the sections related to the type of filing you are submitting, ensuring all required checkboxes are filled.

05

If applicable, include any prior filing references or identification numbers relevant to your submission.

06

Review the form for accuracy and completeness, making sure all sections are filled out as required.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form according to the instructions provided, whether electronically or by mailing it to the designated address.

Who needs DSCB 15-134B?

01

Individuals or businesses filing for specific regulatory compliance in Pennsylvania.

02

Corporations, partnerships, or associations that need to submit this form for registration or reporting purposes.

03

Those who are updating or amending previously filed documents related to business operations in the state.

Fill

dcsb 15 134b

: Try Risk Free

People Also Ask about tax property required

Why is tax day April 18?

The deadline to file taxes is upon us. This year, it falls on Tuesday, April 18 — the result of the District of Columbia's observance of Emancipation Day on Monday and the fact that the typical deadline, April 15, fell on a weekend.

How do you calculate tax on income?

In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. What's left is taxable income. Then we apply the appropriate tax bracket (based on income and filing status) to calculate tax liability.

What does income tax mean on fafsa?

Income tax amount is the total of IRS Form 1040---line 22 minus Schedule 2----line 2. If negative, enter a zero here.

What is a person's taxable income quizlet?

Taxable income. Taxable income is the amount of income that is used to calculate an individual's or a company's income tax due. Taxable income is generally described as gross income or adjusted gross income minus any deductions, exemptions or other adjustments that are allowable in that tax year.

What are examples of personal taxes?

Individual and Consumption Taxes Individual Income Taxes. Excise Taxes. Estate & Gift Taxes.

What is California income tax?

California has a progressive income tax system, with nine tax rates ranging from 1% to 12.3%. Income over $1 million is subject to an additional 1% tax surcharge. The California state standard deduction is $5,202 for single filers and those married filing separately, and $10,404 for all other filing statuses.

How is a person's income tax determined?

Filing status, amount of taxable income and the difference between marginal and effective tax rates determine a taxpayer's federal income tax rate.

What is a person's income tax?

The individual income tax (or personal income tax) is a tax levied on the wages, salaries, dividends, interest, and other income a person earns throughout the year. The tax is generally imposed by the state in which the income is earned.

How much tax do you pay on $10000?

That means that your net pay will be $9,125 per year, or $760 per month. Your average tax rate is 8.8% and your marginal tax rate is 8.8%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is income tax?

Income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. By law, businesses and individuals must file an income tax return every year to determine whether they owe any taxes or are eligible for a tax refund. Income taxes are typically calculated as a percentage of an individual's or a company's profits, wages, or other forms of income.

Who is required to file income tax?

In the United States, anyone who earns income is required to file an income tax return. This includes people with full-time jobs, people who are self-employed, and people who receive income from investments.

How to fill out income tax?

Filling out income tax forms can seem like a daunting task, but with a little guidance, it can be easily accomplished. Here's a step-by-step guide to help you:

1. Gather all your necessary documents: Collect all financial documents like W-2 forms (for income earned as an employee), 1099 forms (for additional income sources such as freelance work or investments), and records of any deductions or credits you may be eligible for.

2. Choose the right tax form: Select the appropriate tax form that corresponds to your situation. Most individuals will use Form 1040, but there are other versions available, such as 1040EZ or 1040A if you meet specific criteria.

3. Fill out personal information: Enter your personal details such as your name, address, social security number, filing status, and any dependents you may have.

4. Report your income: Enter the income amounts from your W-2 and 1099 forms (such as wages, salaries, tips, and interest earned) on the appropriate lines of your chosen form. If you have multiple sources of income, make sure to include them all accurately.

5. Claim deductions and credits: Determine if you qualify for any tax deductions or credits that can help lower your taxable income. Common deductions include mortgage interest, student loan interest, and medical expenses, among others. Credits, such as the Child Tax Credit or Earned Income Tax Credit, can also reduce your tax liability.

6. Calculate taxes owed or refund due: Use the tax tables or an online tax calculator to determine your tax liability or refund amount based on your income, deductions, and credits.

7. Report payments and credits: Enter any taxes you have already paid throughout the year, like withholding taxes from your paycheck or quarterly estimated tax payments.

8. Complete additional forms or schedules: Depending on your specific circumstances, you may need to fill out additional forms or schedules to include more complex income or deductions, such as self-employment income (Schedule C) or capital gains (Schedule D).

9. Review and sign: Carefully review all the information you've entered to ensure accuracy and prevent errors. Sign and date your tax return, and if filing jointly with a spouse, ensure they also sign their section.

10. File your tax return: You can file your tax return electronically using tax software, or you can mail a physical copy to the appropriate tax authority. Be sure to check the filing deadline for your country or region.

Remember, these steps provide a general guideline, and it's always advisable to consult a tax professional if you have complex financial situations or questions about specific deductions or credits.

What is the purpose of income tax?

The purpose of income tax is to generate revenue for the government to fund public services and programs. It is a way for governments to collect money from individuals and businesses based on their earnings or profits. This revenue is used to fund various government functions such as infrastructure development, healthcare, education, defense, social welfare programs, and other public services that benefit the overall population. Income tax is also used as a means of redistributing wealth and reducing income inequalities within a society.

What information must be reported on income tax?

The information that must be reported on income tax typically includes:

1. Personal information: This includes the taxpayer's full name, Social Security number (or taxpayer identification number), and contact information.

2. Income sources: Details about all sources of income must be reported, including wages, salaries, self-employment income, rental income, investment income, and any other form of earned or unearned income.

3. Tax deductions: Taxpayers can claim certain deductions to reduce their taxable income. These deductions may include expenses related to education, healthcare, mortgage interest payments, state and local taxes, charitable donations, etc.

4. Tax credits: Taxpayers should report any eligible tax credits they are entitled to, such as the Child Tax Credit, Earned Income Tax Credit, Lifetime Learning Credit, and others. These credits directly reduce the amount of tax owed.

5. Capital gains and losses: If a taxpayer sold any capital assets like stocks, bonds, real estate, or other investments during the tax year, they need to report the details of these transactions, including the purchase and sale price, to calculate capital gains or losses.

6. Business income: If the taxpayer owns a business or is self-employed, they need to report their business income separately. This includes revenue, expenses, and any applicable deductions related to the business.

7. Foreign assets and income: Any income earned from foreign sources should be reported, as well as any foreign financial accounts or assets exceeding a certain threshold.

It is important to note that tax laws and reporting requirements can vary by jurisdiction, so it is advisable to consult with a tax professional or refer to the appropriate tax authority for specific guidelines.

How do I complete 15 134b online?

With pdfFiller, you may easily complete and sign income withheld excess online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my 134b division printable in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your statement dcsb15 134b division right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit taxpayer tax excess straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing docketing statement 134b, you need to install and log in to the app.

What is DSCB 15-134B?

DSCB 15-134B is a form used in Pennsylvania for the registration of a foreign association to conduct business within the state.

Who is required to file DSCB 15-134B?

Foreign associations that intend to do business in Pennsylvania are required to file DSCB 15-134B.

How to fill out DSCB 15-134B?

To fill out DSCB 15-134B, provide the association's name, jurisdiction of formation, principal office address, registered office address in Pennsylvania, and details about the association's business activities.

What is the purpose of DSCB 15-134B?

The purpose of DSCB 15-134B is to register a foreign association with the Pennsylvania Department of State, allowing it to legally conduct business in Pennsylvania.

What information must be reported on DSCB 15-134B?

The information that must be reported includes the foreign association's name, jurisdiction of formation, principal office address, registered office address in Pennsylvania, and any other necessary details about its business activities.

Fill out your DSCB 15-134B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxable Taxed is not the form you're looking for?Search for another form here.

Keywords relevant to taxpayer withheld excess

Related to section tax excess

If you believe that this page should be taken down, please follow our DMCA take down process

here

.